When you take a loan, you agree to repay it in Equated Monthly Installments (EMIs) over a specific tenure. EMIs are fixed monthly payments that include both the principal amount (the actual loan) and the interest charged by the lender.

There are two primary methods to calculate EMIs:

- Flat-Rate EMI

- Reducing-Balance EMI

Let’s explore both in detail with examples.

1. Flat-Rate EMI

In the flat-rate method, interest is calculated on the entire loan amount for the entire tenure, regardless of how much you’ve already repaid.

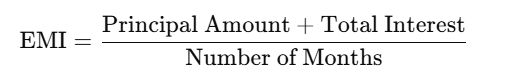

Formula for Flat EMI

Total Interest:

Total Interest = Principal Amount × Annual Interest Rate × Loan Tenure (in years)

Example:

- Loan Amount: ₹5,00,000

- Annual Interest Rate: 10%

- Loan Tenure: 2 years

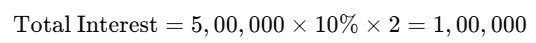

- Calculate Total Interest:

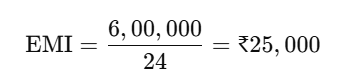

- Calculate Total Amount to Be Paid:

- Calculate EMI:

So, you’ll pay ₹25,000 per month for 24 months.

2. Reducing-Balance EMI

In the reducing-balance method, interest is charged only on the remaining loan balance after each repayment. As a result, the interest component decreases over time, and the EMI includes a higher proportion of principal repayment toward the end.

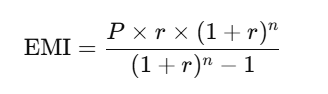

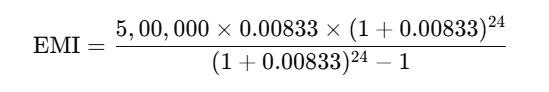

Formula for Reducing EMI:

Where:

- P: Principal Amount

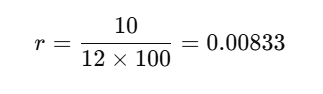

- r: Monthly Interest Rate (Annual Interest Rate/12/100)

- n: Number of Months (Loan Tenure ×12)

Example:

- Loan Amount: ₹5,00,000

- Annual Interest Rate: 10%

- Loan Tenure: 2 years

- Calculate Monthly Interest Rate:

- Number of Months:

n = 2×12 = 24

- Calculate EMI:

After calculating: EMI= ₹23,074

- Interest Decreases Each Month:

Initially, interest is calculated on ₹5,00,000. After the first EMI, the principal reduces, so the interest in the second month is calculated on the remaining balance, and so on.

Key Differences Between Flat and Reducing EMIs

| Feature | Flat-Rate EMI | Reducing-Balance EMI |

|---|---|---|

| Interest Calculation | On the entire loan amount | On the outstanding loan balance |

| EMI Amount | Fixed for all months | Varies slightly (higher at first) |

| Total Interest Paid | Higher | Lower |

| Transparency | Less transparent | More transparent |

Which EMI Type Is Better?

- Flat-Rate EMI is simpler to calculate but typically results in higher total interest. It’s often used for short-term loans, such as consumer durable loans.

- Reducing-Balance EMI is more cost-effective because you pay interest only on the outstanding balance. It’s commonly used for home loans, car loans, and other long-term loans.

A Quick Comparison of Our Examples

| Loan Type | EMI (₹) | Total Interest Paid (₹) | Total Amount Paid (₹) |

|---|---|---|---|

| Flat-Rate Method | 25,000 | 1,00,000 | 6,00,000 |

| Reducing-Balance | 23,074 | ~55,774 | ~5,55,774 |

Conclusion

Understanding the type of EMI calculation is crucial when choosing a loan. While flat-rate EMI may look simple, it often costs more in the long run. Reducing-balance EMI is usually the better option for saving on interest payments.

Before taking a loan, always ask your lender about the calculation method, and use an EMI calculator to compare options and plan your finances wisely!